Will Sba Disaster Relief Loans Be Forgiven

The new rules affect about 35 million loans 68 of all PPP borrowers but only 62 billion or 12 of all the SBA money lent according to the latest SBA figures. If the SBA approves loan forgiveness then you will not be legally obligated to repay the portion of your loan that was forgiven.

The Cares Act Comparing Sba Loan Programs Eidl And Ppp Century Accounting Financial Services

But on Thursday the SBA shed some light on its thinking.

Will sba disaster relief loans be forgiven. Will SBA disaster loans be forgiven. The SBA disaster loan forgiveness program provides for loan forgiveness on a case-by-case basis. There are two disaster loan programs that offer loan forgiveness.

The SBA Disaster Loan is not forgivable in the way that the PPP loan is. Existing SBA disaster loans approved prior to 2020 in regular servicing status as of March 1 2020 received an automatic deferment of principal and interest payments through December 31 2020. Borrowers are expected to repay these loans.

The application consists of a two-page form in addition to required documentation. SBA disaster loans are not forgivable loans. A more accurate way to state it would be that the SBA can choose to forgive your loan under very special circumstances such as you not being able to pay the loan back.

No the SBA does not offer a forgiveness program for disaster loans. The SBA initially said it would streamline forgiveness for loans of 150000 or less. Existing SBA disaster loans approved prior to 2020 in regular servicing status as of March 1 2020 received an automatic deferment of principal and interest payments through December 31 2020.

What Disaster Loan Programs Offer Loan Forgiveness. Loan payments on permitted use including principal interest and fees are deferred until the SBA remits your forgiveness amount to you or if you do not apply for forgiveness for 10 months from. If you have a small business you may qualify if your business was located in a declared natural disaster zone.

All SBA disaster loans made in calendar year 2021 including COVID-19 EIDL will have a first payment due date extended from 12-months to 18-months from the date of the note. These loans must be repaid over 30 years with. You apply through your lender.

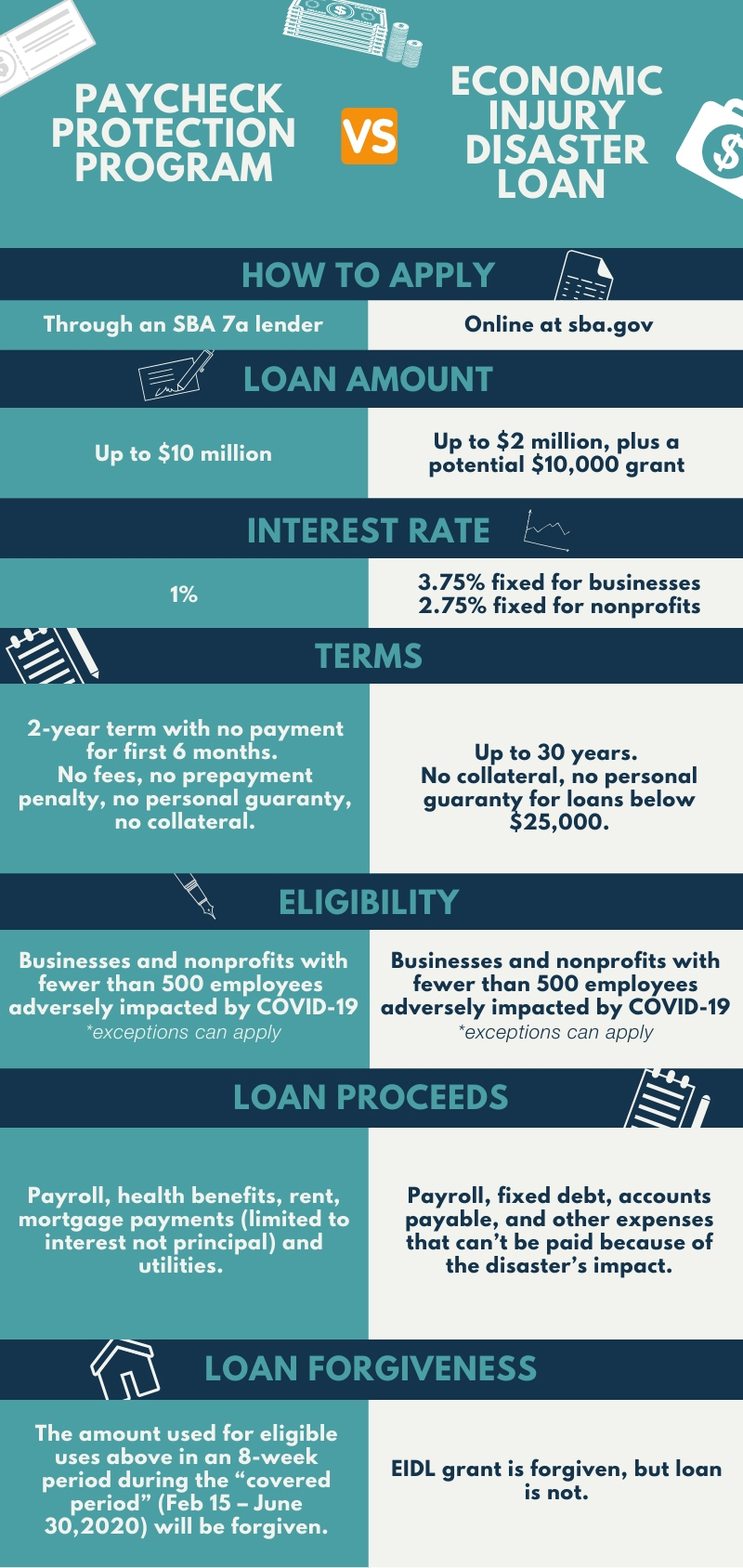

The Economic Injury Disaster Loan EIDL and the Paycheck Protection Program Loan PPP. Some businesses were fortunate enough to qualify and receive disaster loan funds from the Small Business Administration. However businesses must meet the requirements in order to have their loans forgiven.

Will SBA Disaster Loans Be Forgiven. Businesses that qualify for a small business loan under section 7a of the Small Business Act which to qualify the business must be a small business as determined by the SBA size standard corresponding to the business NAICS code or otherwise qualify for the Paycheck Protection Program may qualify for loan forgiveness on portions of their SBA disaster loan. Applications open on Friday April 3 and close on June 30.

If you received an EIDL emergency advance also called the EIDL Grant or Targeted EIDL Advance it does not need to be repaid and the IRS will not consider it to be taxable income. Those who cant get the loan forgiven will have to pay it back in two years at a 05 interest rate after six months of interest deferment. However their approaches to doing so are different.

There are also Paycheck Protection Program loans offering 25x monthly payroll expenses capped at 10 million that can be completely forgiven as long as employers use the money to keep their workers on the payroll for at least eight weeks. Disaster Home and Business Loans. This initial deferment period was subsequently extended through March 31 2021.

These funds designed to keep employees on the payroll and businesses afloat provide partial or full loan forgiveness. Getting an SBA disaster relief grant or loan is a great opportunity for small businesses but its not the only option. A portion of SBA loans this year will be forgiven but how much and for how long varies.

Thanks in large part to the National Restaurant Associations advocacy provisions were built into the coronavirus relief package that make it easier for restaurants to qualify for Small Business Administration loans and get forgiveness on at least some part of the funds borrowed. EIDLs are loans sent from the Small Business Administration SBA. What SBA loans will be forgiven.

Both loans are designed to benefit business owners. Assuming you meet the conditions around using 75 of the Paycheck Protection Program loan on payroll costs this loan can be forgiven.

Sba Disaster Loan Pros And Cons Archives Canterbury Law Group

Sba Disaster Relief Loans Ppp And Other Funding Opportunities Shop Local Raleigh

Sba Disaster Loan Requirements Assistance Eligibility

Blue Williams Covid 19 Cares Act And Sba Business Assistance

Https Www Sba Gov Sites Default Files Articles Eidl And P3 4 14 2020 10 Am Pdf

Quick Guide Sba Disaster Loan Application Specific To Coronavirus Covid 19 Youtube

Sba Disaster Loans Requirements And Application Instructions

Sba Disaster Loan Forgiveness Programs Updates Student Loan Student Loan Forgiveness

Sba Eidl Loan Vs Sba Paycheck Protection Program Tmc Financing

Illinois Businesses Can Now Apply For Disaster Assistance Loans Growth Corp

Sba Covid 19 Disaster Loan Information Upcoming Webinars

Coronavirus Sba Loan Forgiveness Program Youtube

How To Get An Sba Disaster Loan Eidl Bench Accounting

Sba Eidl Loan Vs Sba Paycheck Protection Program Fountainhead Cc

Sba Disaster Loans And Emergency Grants Artist S Edition What You Need To Know

Covid 19 Relief Loans For Small Businesses Masstlc

Sba Has Slashed The Maximum Available On Economic Injury Disaster Loans Newsday

Payment Protection Program Ppp Vs Sba Economic Injury Disaster Loan Eidl Monroe County Chamber Of Commerce

10k Quick Grant From The Sba And Other Features Of The Cares Act Pioneer Media

Post a Comment for "Will Sba Disaster Relief Loans Be Forgiven"